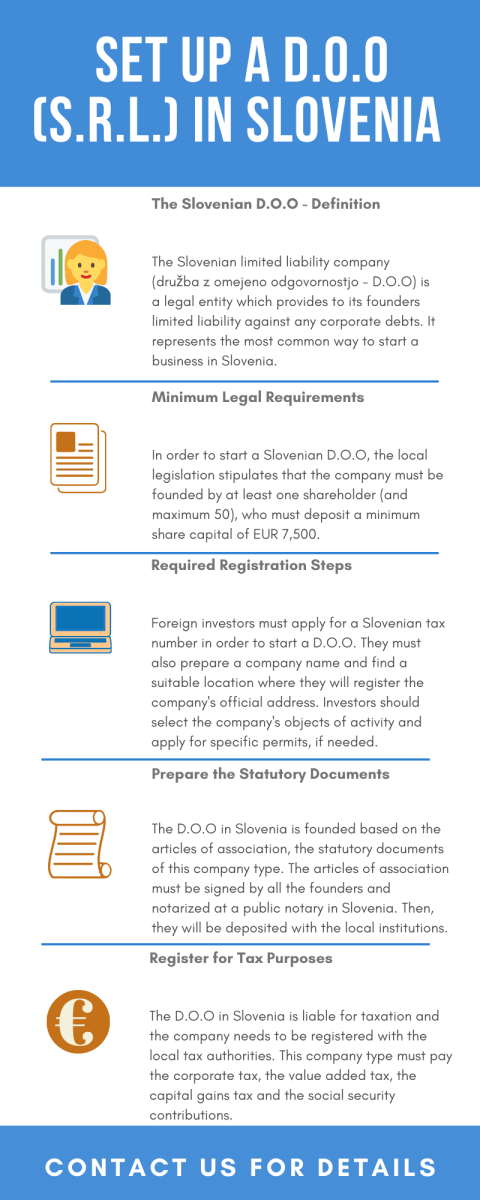

A D.O.O (družba z omejeno odgovornostjo) represents the limited liability company and it is the most popular form a business can take in Slovenia because of the advantageous conditions offered by it. It’s based on a share capital of EUR7,500 and can be formed by at least one shareholder.

Businessmen who intend to open a company in Slovenia should know that any shareholder of a D.O.O benefits from limited liability for the company’s debts. The minimum share capital must be deposited in a bank account. The maximum number of shareholders can exceed 50 only with a special permission from the ministry in charge for economic affairs and our company formation consultants in Slovenia can help you obtain it.

| Quick Facts | |

|---|---|

| Applicable legislation |

Slovenian Company Act |

|

Minimum number of shareholders |

At least one shareholder who can be of any nationality is required to open a DOO in Slovenia |

|

Minimum number of directors |

The minimum number of directors is one |

| Resident director required (YES/NO) |

No, there is no need for a resident director (where a foreign director is appointed, a work permit may be required) |

| Legal address in Slovenia required (YES/NO) | Yes, a DOO must have a local legal address |

| Minimum share capital |

EUR 7,500, 25% must be paid upon incorporation |

| Local bank account required (YES/NO) |

Yes, a private limited liability company must |

| Best used for | Trading activities, as a subsidiary enterprise, e-commerce operations, commercial activities, etc |

| Shareholders liability | The liability of the shareholders is limited to their participation to the company's capital |

| Visit for incorporation required (YES/NO) | No, the process can be completed through a proxy |

| Corporate tax applied to DOO companies | 19% |

| Timeframe for registration (approx.) | Approx. 2 weeks |

| Audited financial statements (YES/NO) | Yes, DOO companies must file audited accounts |

| Advantages of the DOO | Easy and quick to incorporate, reduced bureaucracy, multiple uses, full foreign ownership availability |

| Support in company registration (YES/NO) | Yes, our company formation agents in Slovenia can act as proxy for business incorporation |

Registering a limited liability company in Slovenia in 2024

The registration procedure of a limited liability company in Slovenia is based on the articles of association. The articles must contain the following information: details regarding the founders (name, address), name and address of the company, date of expiration (if it’s a time limited company), obligations of the shareholders, details regarding the invested share capital and each member’s contribution.

Drafting the articles of association of a new company is not an easy task, that is why it is recommended to ask for specialized consultancy from an experienced team of company formation agents in Slovenia. In case you are interested in opening a LLC in another European country, for example setting up a D.O.O. in Montenegro, we can put you in contact with our partners.

The articles must be signed by all the founders and notarized then registered at the VEM offices. If the documents are submitted online, then a certified electronic signature is required. If the contribution to the capital doesn’t consist in cash, then the articles must state the name of the partner who’s making that contribution and the type of the non-cash parts. If the value of this type of contribution exceeds EUR 100,000, the amount must be reviewed by a certified accountant.

The important decisions in a D.O.O are taken by the General Meeting of the Shareholders: increase or decrease the capital, the management and supervisory board appointment, the profit distribution. One or more managers are responsible for the day-to-day decisions and must be appointed by the General Meeting for a period of minimum 2 years. After this period, they can be re-elected. The residence and nationality of the managers are not mandatory to be Slovenian.

The articles of association may contain the reasons why a manager can be recalled. Also, a limited liability company may have a Supervisory Board, if it’s stated in the articles of association, but is not mandatory. If you need more details about the characteristics of a limited liability company, our company formation consultants in Slovenia are at your disposal.

What should an investor prepare for the registration of a Slovenian D.O.O?

As presented above, the registration procedure is comprised of a set of legal steps and numerous documents. Thus, in order to avoid any possible delays, it is highly recommended to prepare the necessary documentation and to observe the requirements imposed in Slovenia for the registration of a limited liability company. Our team of specialists in company registration in Slovenia can provide legal representation on the following:

- as a non-resident of Slovenia, investors can easily set up a local business, but they need to apply for a Slovenian tax number prior to registering the company;

- before registering the legal entity, the local authorities will require a set of information concerning the data of the future company;

- thus, it is necessary to apply for a company name, which must be different than the ones of the companies that have already been registered in this country;

- the company needs to have an official business address and the formalities for obtaining a registered office have to be done before the incorporation procedure;

- the investors must also select the company’s object of activity which, in specific cases, may need the issuance of business license or permit.

If you want to open a DOO in Slovenia in 2024, our specialists can provide tailored assistance. We can also help you register the business with the local tax authorities.

What should an investor know on the Slovenian D.O.O for 2024?

Apart from the fact that the company’s shareholders will benefit from limited liability, that is limited to their contribution to the company’s capital, the Slovenian D.O.O. presents other relevant characteristics. For example, it can be registered with the local authorities through two types of registration procedures – a simplified procedure and a complex procedure, that is performed through a public notary in Slovenia.

The company is charged with the corporate taxes available under the Slovenian tax law, since it develops commercial activities in this country. This business form is imposed with the corporate tax, that is applicable at a rate of 19%; at the same time, the Slovenian D.O.O. must make the necessary arrangements to keep its accounting documents following the accounting procedures available at a national level.

This business form can also be ideal for applying for loans with the local banking institutions (other entities, such as the sole trader, does not benefit from this, or if it does, it can obtain a loan much harder compared to the Slovenian D.O.O.).

Investors who want to open a company in Slovenia as a limited liability company in 2024 can register this legal entity in a period of only one week, as long as all the documents are prepared for each registration step. This represents a short period of time, as the registration of other business structures, such as the branch office or the subsidiary require several weeks.

The limited liability company is also the most suitable legal entity for those who want to expand their operations in Slovenia in 2023 as it can be used for the incorporation of a subsidiary.

We can assure you that the process of setting up a Slovenian limited liability company is one of the simplest at the level of 2024.

What types of taxes are applicable to a Slovenian D.O.O.?

As a commercial entity, the Slovenian D.O.O. is legally required to register with tax authorities in Slovenia and then pay accordingly. As we presented above, this business form needs to pay the corporate tax, but other taxes are applicable for this structure; our team of specialists in company registration in Slovenia can offer an in-depth presentation on the requirements for registering with the following:

- value added tax (VAT) – it is imposed at the standard rate of 21%, but local businesses can also benefit from reduced VAT rates;

- social security contributions – paid on the salaries of the company’s employees (the company has to pay 16,1% from the value of the salary);

- capital gains tax – it varies between 0-25% and our team of consultants in company formation in Slovenia can provide information on when a business is exempted from the payment of the tax;

- Slovenian businesses may also benefit from tax reliefs for investments in specific sectors;

- the tax relief can increase up to 100% provided that the investment is done in the field of research and development.

Additional taxes can be imposed on Slovenian businesses, but this depends on their field of activity. For example, companies that are involved in international shipping may be subjected to the tonnage tax. This type of tax can replace the corporate income tax, but several requirements have to be met in this case, which can be detailed by our team of consultants in company formation in Slovenia.

The taxation is done taking into consideration each of the ships owned by the company, the number of days in which each ship operated and the value of each cargo (measured in tons). However, in order to benefit from this type of tax, the company need to address to the Slovenian authorities in advance.

Economic overview for Slovenia

Economic growth is anticipated to accelerate due to the sustained high level of investment activity and anticipated increases in buying power, even as inflation is set to ease to 3.9% in 2024. GDP growth is anticipated to gradually pick up speed over the course of the year, reaching 2% in 2024 and 2.7% in 2025. Private spending is expected to pick back up after a 2023 pause, helped by strong employment and steady salary growth. Export is also anticipated to pick up speed as the external demand is predicted to rise. The contribution from net exports is expected to remain modest because imports are expected to expand at a similar rate. Construction is expected to be the primary driver of investment growth, with additional machines contributing in 2025.

If you want to open a company in Slovenia in 2024 and decide for a limited liability entity, our specialists in company formation can guide you. You can also watch our video below:

Closing a limited liability company in Slovenia

A limited liability company in Slovenia can be liquidated in the following situations: the time stated in the articles of association expires, if at least three-quarters of the members vote this decision (in the articles of association, a larger majority may be established), in case of bankruptcy, if the court decides so, if the capital is reduced below EUR 7,500 or if the company is merged with another one.

If you need professional company formation assistance for establishing a D.O.O in Slovenia or any other type of company, feel free to send us a detailed e-mail about your project. Our Slovenian company formation agents will respond to you with a customized offer as fast as possible.